Tax Residence in Andorra: how to get a residence permit and become a tax resident

Table of contents

- What is tax residency?

- Why do you get tax residency in Andorra?

- Requirements for obtaining tax residency in Andorra

- Advantages of tax residency in Andorra

- Andorra's tax system

- How to become a tax resident in Andorra?

- Are you planning to move abroad? Take out a health insurance policy to feel at home in any country in the world.

- What is the duration of registration of tax residency?

Are you planning to move to Andorra for tax residency? Andorra offers several different types of residence depending on your needs. In our article, we will tell you how to obtain tax residence in Andorra, what are the requirements and benefits

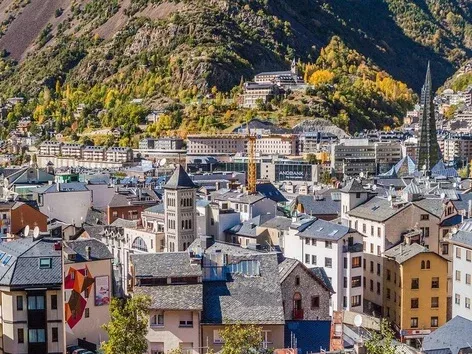

Combining an optimal tax environment and a high quality of life within one country is the dream of many businessmen and investors. And in fact it is possible! It is interesting that such a place is located in the very heart of Europe, between France and Spain.

Andorra is a country that is well known in the world for its tax-free status, rich nature and highly developed social sphere.

How to get tax residency in Andorra? What advantages will the businessman get? Let's talk further.

The best countries in Europe for expats to live in 2023 are here.

What is tax residency?

In fact, tax residency means in which country you have to pay taxes. Most often, the status of a tax resident is acquired after 183 days of residence in the country (but there are other conditions).

Why do you get tax residency in Andorra?

Tax rates differ significantly depending on the state. In the countries of Scandinavia (Norway, Sweden, Finland) the personal income tax is approximately 32%, the federal tax rates in the USA vary from 10% to 37%, and the citizens of Cote d'Ivoire are forced to give 60% of their income to the state. At the same time, countries such as Bermuda, Monaco and the Bahamas are recognized as tax havens. They attract entrepreneurs with very low taxes.

Andorra is not a tax haven, it is recognized as a low tax jurisdiction like Montenegro and Singapore. This means that the state is located between tax havens and countries with high taxes. Thus, Andorra attracts businessmen who want to reduce their costs, but still remain accountable to the government of the country of origin.

Requirements for obtaining tax residency in Andorra

According to Andorran law, there are three main requirements for obtaining tax resident status in the country:

● The applicant must legally reside in the state most of the time - the person is considered a tax resident of the region in which he has a permanent residence and resides there for a minimum of 183 days per year.

● Center of economic interest in Andorra, i.e. part of your income must be connected to Andorra.

● The family resides in Andorra - this applies to the spouse, minor children and other close relatives who are dependent on the applicant.

Advantages of tax residency in Andorra

● Low taxes - A quick comparison of global tax rates shows that Andorra's 10% personal income tax is one of the lowest. Although the Bahamas and Monaco have better tax rates due to being harbors. Residency in these countries can cause a number of problems for foreigners who have to prove their citizenship in the country where they pay taxes.

● High standard of living - Andorra is a very safe country with one of the highest life expectancies in the world. There are also many educational institutions, including international ones, operating in the state. Andorra's nature and numerous places for recreation and tourism deserve special attention.

Andorra's tax system

● Personal income tax – 10% tax is the maximum rate for any individual, but the exact amount of tax depends on your personal income: you pay 0% if you earn between €0 and €24,000, 5% if you earn €24 001 – €40,000 and 10% if the amount of earnings exceeds €40,000.

● Corporate income tax – a business registered in Andorra must pay corporate taxes. They range from 0% to 10%.

● Value added tax in Andorra is the lowest in Europe - 4.5%.

There are not many other taxes in Andorra. For example, there is no inheritance tax, wealth tax or gift tax.

How to become a tax resident in Andorra?

Foreigners who have obtained a permanent residence permit can stay in Andorra legally for a long time.

There are two types of accommodation in Andorra: active and passive. The active residence permit is intended for people who intend to work and live in Andorra and participate in the Andorran social security and health care system.

A passive residence permit is more suitable for those who earn a living outside of Andorra but want to live here for most of the year.

Are you planning to move abroad? Take out a health insurance policy to feel at home in any country in the world.

Possible ways to issue this permit:

● Participation in the state PR program in exchange for investments.

To obtain a permit, investors can:

- purchase real estate;

- open an interest-free deposit;

- buy securities;

- invest in local business.

The minimum amount of investments in the country's economy is 350,000 euros, the size of the insurance deposit with the Central Bank of Andorra must be above 50,000 euros.

The PR of Andorra on the basis of investment does not give the right to work or open a business in the country - all income must be received from abroad.

● Passive residence for international business owners – for foreigners who do business outside of Andorra. Your company headquarters must be in Andorra and you will need to employ at least one person. You must perform 85% of your activities outside the Principality. In addition, you must provide a complete business plan and reside in Andorra for at least 90 days per year.

● Residence permit for talents - this document can be obtained by outstanding researchers, artists or sportsmen who conduct non-commercial activities in Andorra.

What is the duration of registration of tax residency?

The estimated period of processing documents is up to 6 months.

Tax residency in Andorra is beneficial for individuals, families and businesses. Are you interested in moving to this European country? Find out everything about tax residency in Andorra with the advice of a highly qualified lawyer.

Products from Visit World for a comfortable trip:

Checklist for obtaining a visa and necessary documents in Andorra;

Legal advice for business in Andorra;

Travel and medical insurance for foreigners in Andorra;

Insurance for international students in Andorra.

We monitor the accuracy and relevance of our information. Therefore, if you see any error or discrepancy, please write to our hotline.

Recommended articles

2 min

Popular

The most helpful 16 tips for first time travelers

Getting ready to travel for the first time? Learn more about how to plan your trip, what to pack, safety tips, and more. With these tips, you'll be ready to travel with confidence!

31 Jul. 2023

More details3 min

Residence permit

CRS system: how many points required to move to Canada under Express Entry

Foreigners planning to immigrate to Canada are ranked using the Comprehensive Ranking System (CRS). Find out more about how many CRS points you need to score to participate and how many points you need to score to be eligible to move to Canada

01 Aug. 2023

More details3 min

Expats

E-Devlet: How to join Turkey's e-government service portal?

E-Devlet is a convenient online system for providing government electronic services in Turkey. It works not only for Turkish citizens but also for foreigners. How to use E-Devlet and what services are available on the portal is described in the article

02 Aug. 2023

More details2 min

Work

Moving to the US: Types of Work Visas in US and How to Get One in 2025

Want to work in the USA? Learn about the most popular work visas in 2025, requirements, application procedure, and how to legally move to America

16 Jul. 2025

More detailsAll materials and articles are owned by VisitWorld.Today and are protected by international intellectual property regulations. When using materials, approval from VisitWorld.Today is required.